Introduction to Cross-Chain Transactions

In the ever-evolving panorama of decentralized finance, cross-chain transactions have emerged as a pivotal innovation, fundamentally altering the way digital assets are maneuvered across disparate blockchain networks. The prominence of cross-chain transactions is embedded in their capacity to facilitate seamless interoperability among blockchains, which were traditionally siloed ecosystems with idiosyncratic protocols. Such transactions enable token movement across multiple blockchain platforms, thereby broadening the scope of diversification and flexibility available to cryptocurrency holders.

At the core of cross-chain transactions lies the ingenious mechanism of token swapping. Token swapping enables the exchange of one cryptocurrency for another, potentially on different blockchains, without necessitating an intermediary. This is accomplished through various protocols, some of which employ advanced cryptographic techniques like atomic swaps. These protocols ensure that the transfer of assets occurs concomitantly, thus mitigating risks of transaction failure or fraud by ensuring that both participating parties fulfill their obligations before any transfer is finalized.

The significance of cross-chain transactions cannot be understated within the larger cryptocurrency landscape. They not only enhance liquidity by allowing assets to traverse multiple chains but also foster a more user-centric blockchain experience. As decentralized finance protocols continue to burgeon, the ability to exchange and interact efficiently across various networks stands as a bulwark against the limitations of a segregated blockchain ecosystem. Consequently, cross-chain technology is a catalytic force, driving towards a more interconnected and fluid digital economy. With ongoing research and development focusing on optimizing these transactions, it is anticipated that the proliferation of cross-chain solutions will further unlock the latent potential within blockchain technologies, heralding an era of unprecedented connectivity and innovation.

How Squid Router Facilitates Cross-Chain Transactions

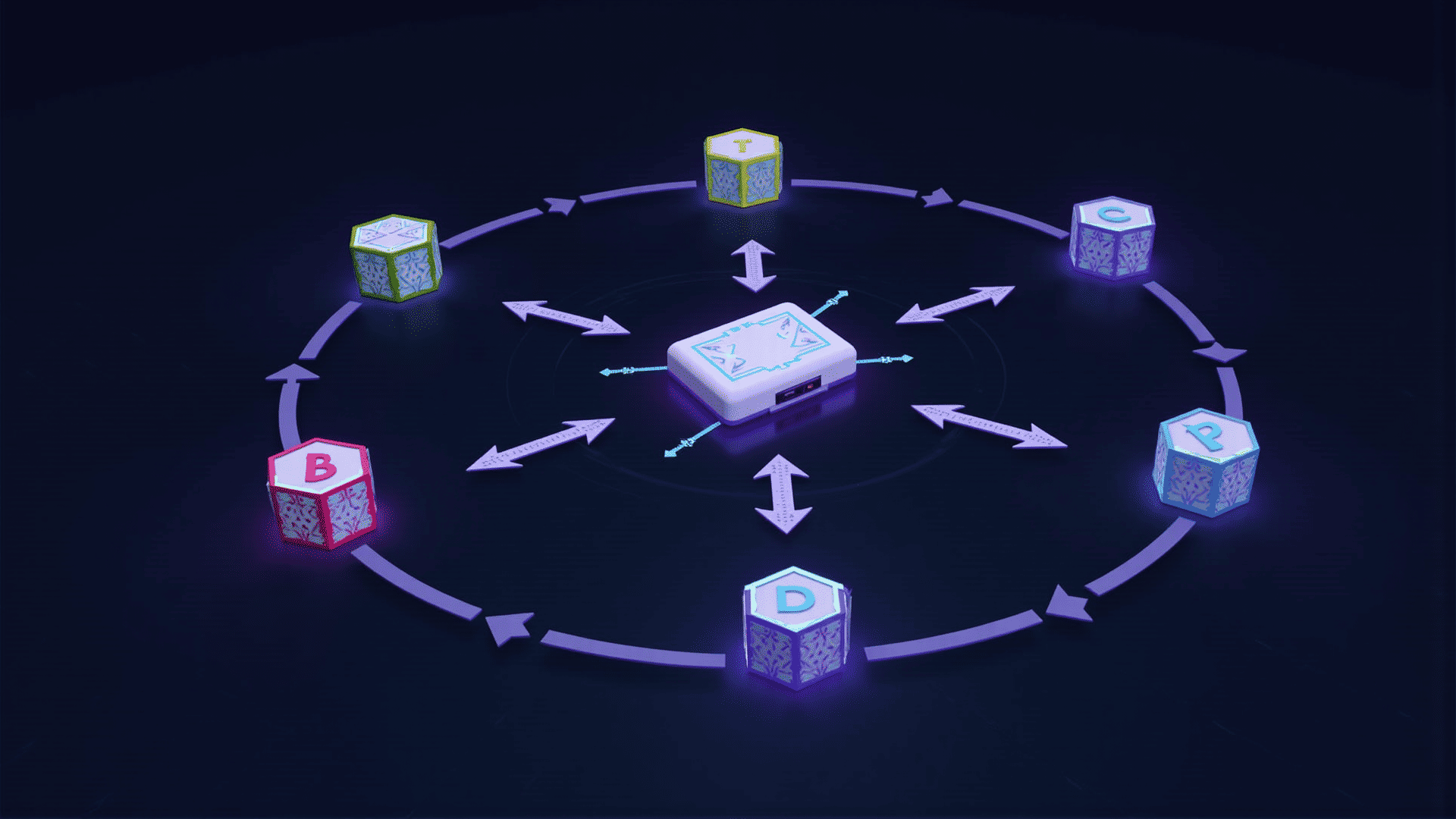

At the heart of Squid Router’s innovative capabilities lies its proficiency in orchestrating cross-chain token transactions, a domain often plagued by complexity and inefficiency. Squid Router is akin to a digital polyglot within the blockchain ecosystem, adept at facilitating communication between disparate blockchain networks. It circumvents the traditional silos that have long isolated blockchain ecosystems, thereby opening the floodgates to liquidity and resulting in a more cohesive financial experience for users.

The Squid Router achieves this by acting as a bridge, utilizing a sophisticated amalgamation of smart contracts and interoperability protocols to meticulously exchange tokens between chains. It adeptly disentangles the otherwise convoluted process of Token Swapping, converting them into seamless transactions that belie the underlying intricacies. Users can execute swaps across a multitude of blockchains without having to compromise on speed or security, sidestepping the labyrinthine processes that previously hindered efficiency.

Furthermore, the integration of Squid Router into Decentralized Finance (DeFi) platforms marks a significant pivot towards greater inclusivity in the financial space. By enabling a frictionless conversion of assets across networks, Squid empowers users to diversify their holdings and harness opportunities across the expansive DeFi landscape. This not only amplifies the utility of digital assets but also glorifies the user experience, standing as a testament to the perennial evolution of technology in transforming abstract potentials into tangible realities.

Benefits of Cross-Chain Transactions in DeFi

As the decentralized finance ecosystem matures, the integration of cross-chain capabilities emerges as a pivotal innovation, unleashing a multitude of benefits for both developers and users. Chief among these advantages is the enhanced liquidity that cross-chain transactions bring to the table. By bridging disparate blockchain networks, decentralized finance applications can tap into a broader spectrum of assets, thereby increasing the volume of available liquidity in any given protocol. This interconnectedness facilitates more robust price discovery mechanisms and allows traders to exploit arbitrage opportunities across different chains with heightened efficiency.

Moreover, cross-chain interactions circumvent the limitations imposed by single-chain ecosystems, fostering an environment of greater flexibility and inclusivity. Users are no longer confined to a singular blockchain’s offerings or token standards; instead, they can seamlessly interact with, swap, or leverage assets across multiple chains. This versatility not only augments the user experience but also reduces friction for asset holders who wish to diversify their digital portfolios beyond the confines of a solitary blockchain. For instance, token swapping offers a practical way to achieve such flexibility in diverse markets.

In addition to these user-centric benefits, cross-chain transactions also promote innovation within the DeFi space. Developers can experiment with novel financial instruments and strategies that draw upon the unique attributes of different blockchains. This interoperability nurtures a collaborative ethos, enabling networks to benefit from each other's technological advancements while cultivating an ecosystem where multi-chain DeFi applications can thrive.

Furthermore, by facilitating communication between various blockchains, cross-chain transactions help decentralize risk management, allowing for more resilient and secure DeFi platforms. Protocols can distribute their governance and decision-making across multiple chains, mitigating the risk of congestion, exploitations, or failures that could arise from an over-reliance on a single network. In essence, cross-chain capabilities serve as a linchpin for a more robust, interconnected, and dynamic decentralized finance landscape.

Challenges and Future of Cross-Chain Solutions

Cross-chain solutions, designed to facilitate interoperability between disparate blockchain networks, often encounter a myriad of formidable challenges. One of the primary obstacles is ensuring security, as the interconnected nature of these systems can compound vulnerabilities. Malicious actors might exploit these expanded attack surfaces, making robust security protocols imperative. Ensuring that these protocols are both airtight and efficient is a task that requires sophisticated cryptographic techniques and constant vigilance.

Another significant challenge is the lack of standardized protocols across different blockchains. Each platform typically has its own unique architecture, making universal interoperability a complex endeavor. This heterogeneity necessitates extensive custom development efforts for each cross-chain solution, which can be resource-intensive and may hamper widespread adoption.

Token Swapping is a common application within cross-chain solutions, highlighting the need for seamless asset transfer across different networks. Scalability is also a pertinent issue, as cross-chain technologies must support numerous, potentially high-frequency transactions without compromising performance. Solving speed and throughput challenges is crucial for the successful integration of these solutions into mainstream applications.

Despite these hurdles, the future of cross-chain solutions in the blockchain landscape is replete with possibilities. The relentless pace of innovation suggests that technological advancements will gradually mitigate current limitations. Emerging technologies such as quantum computing and advanced artificial intelligence could revolutionize cryptographic practices, enabling enhanced security and efficiency.

Moreover, as the blockchain ecosystem burgeons and more traditional industries recognize its potential, there will likely be a collaborative push towards greater standardization. This collective effort could streamline development processes and accelerate the implementation of robust cross-chain architectures.

Furthermore, the transition towards Decentralized Finance and Web3 is likely to spur demand for seamless asset transfer and communication across networks, driving further innovation in cross-chain solutions. As blockchain technology continues to permeate various sectors, it will be imperative for cross-chain solutions to evolve adaptively, ensuring they remain a cornerstone of a connected and decentralized future.